Sky-high standards, an expanding market, and a supportive government have catalyzed a wave of experimentation in the emirate – and a boom in retail

If you want to glimpse the future of retail, the Dubai Retail Summit is where you’ll find it. The event gathers leading global brands Harrods and Harvey Nichols, alongside regional giants such as the Chalhoub Group and Magrabi Retail Group, for networking, panel discussions, and TED-style talks on the current state of the industry – and where it’s headed next.

The headline topic at this year’s event – held in March 2023 – was ecommerce. Digital shopping may have fallen from its pandemic-era peak, but it remains the dominant trend in retail.

But discussion was equally focused on a seemingly contradictory trend: Experiential retail. The emerging picture was of future retailers deftly balancing opposing forces – convenience and experience, online and physical, digital and human. It’s a future that’s already playing out in Dubai.

The rise of ecommerce

Retail is booming in Dubai. In the four quarters preceding October 2022, the sector grew an average 11.25% against the same period in pre-pandemic 2019.

Speaking at the Retail Summit, Mohammed Ali Rashed Lootah, President and CEO of Dubai Chambers – which co-hosted the event – said, “The major driver for the increase in retail activity is ecommerce.”

Online shopping in the UAE grew 20% in 2022, driven by its unparalleled convenience – especially for consumers far from bricks-and-mortar retailers. It’s also a major opportunity for retailers, who can sell to customers regardless of physical proximity.

But ecommerce also unlocks new models to address changing consumer concerns, such as sustainability.

“We’re creating a circular economy”

— Kunal Kapoor, CEO and founder of The Luxury Closet

Dubai-based The Luxury Closet facilitates second-hand sales of luxury fashion items. “To buy a Chanel bag is like buying a car, that’s how much it costs” says CEO and founder Kunal Kapoor. “Most of the car industry is pre-owned. So, most of Chanel should be as well.”

Just as with cars, much of fashion’s emissions are made in production. So, embracing pre-owned means significantly reducing the industry’s environmental impact. “We’re creating a circular economy,” says Kapoor.

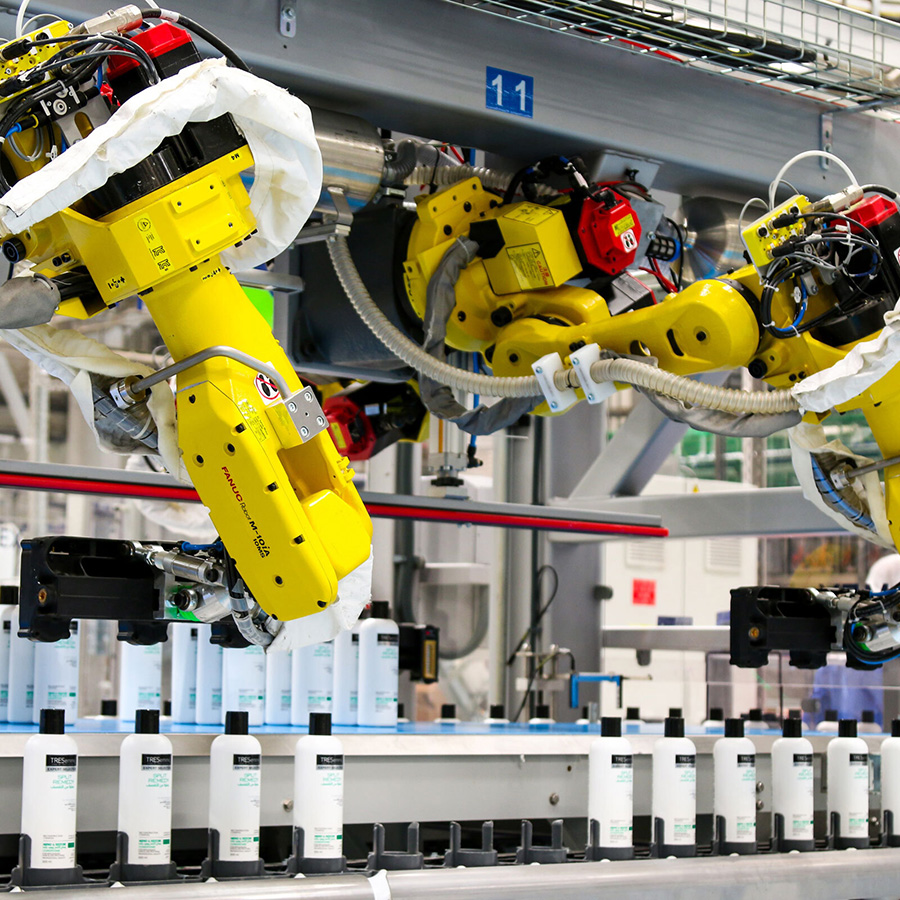

It’s a model enabled by technology. The company uses machine learning to effectively price and position each item, according to what it is, how old it is, and what condition it’s in. But while The Luxury Closet is using technology to facilitate new models online, technology is also enhancing the bricks-and-mortar experience.

Omnichannel experience

“81% of consumers are willing to pay more for a better experience,” says Maria Gedeon Mohr, CEO of Dubai-based consultancy Gedeon Mohr & Partners.

Magrabi Retail Group is one of the Middle East's leading eyewear retailers, with its headquarters in Dubai. It has always differentiated itself on experience. “What makes the Magrabi Retail Group customer journey unique is our service quality,” says CEO Yasser Taher. “We invest a lot in our team. We invest a lot in our technology.”

That technology investment used to mean optometry machines and lens manufacturing. But now it also means experiential tech: analytics, augmented reality (AR), and AI.

“Our recommendation systems use facial recognition to help you choose the best frames using your face shape versus your style advice,” says Taher. And customers can use Instagram filter-style virtual try-ons to see how glasses will look without leaving their home.

“What makes the Magrabi Retail Group customer journey unique is our service quality.”

— Yasser Taher, CEO of Magrabi Retail Group

They can also visit the store for an IRL fitting, or book an appointment with a stylist – online or in-person – to go through their options.

And it works both ways. “You might come into the store for the experience, and then decide to buy it online. It doesn’t matter where the transaction happens,” says Taher.

Magrabi Retail Group is also investing in analytics to enhance the customer journey across digital and physical, something Mohr says is a wider trend in the industry – using demographics, past purchases, and in-store heatmapping to personalize experiences and better predict inventory requirements.

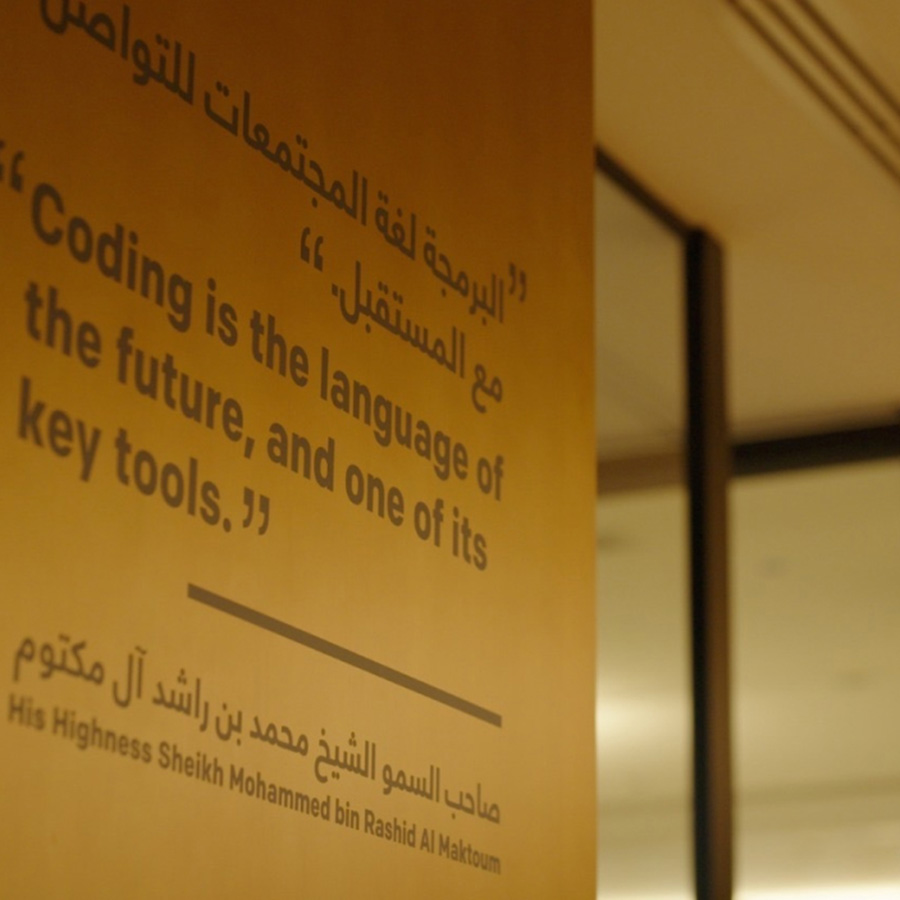

This cutting-edge, omnichannel approach is typical of Dubai, a city that Mohr characterizes as “a testbed for innovation.”

Shaping the future of shopping

Dubai’s consumers have “the highest expectations in the world,” says Taher, driving an intense competition that “automatically drives innovation.” In other words: retailers willing to try new ideas are richly rewarded.

And Mohr says the government is also “committed to promoting innovation and entrepreneurship, creating a dynamic environment that encourages retailers to experiment.”

For instance, Dubai Chambers – which co-hosted the Retail Summit – has created business groups to consult on policy and regulation. Part of the optical business group, Taher says the Chambers are “not only trying to align with retailers, but actually use retailers in every sub-specialty to think outside the box.”

Further support comes from the Dubai Economic Agenda ‘D33’, which aims to expand cross-border trade opportunities by forging new trade agreements and logistics corridors. It also seeks to bring more tourists to the emirate, swelling the number of potential customers.

Such moves could bring further international brands to the emirate – already home to a who’s who of global brands like Chanel and Dior – as well as supporting outward expansion from Dubai.

With such colossal – and growing – opportunity, it’s no surprise the future of shopping is being forged in Dubai.

Why Dubai?

International retailers are flocking to Dubai. 62% of international retailers are already there with recent arrivals including: LensKart (India), Chai Trading (Kenya), Wow! Momo (India). Here’s why.

Dubai also offers an entrepreneurial, pro-business environment that is home to leading regional retailers. Prime examples of this include Chalhoub, luxury retailer and the largest retail operator in the Middle East with 14,000 employees in 14 countries; 6thstreet, the GCC's leading fashion e-tailer selling 1,200 brands to five countries experimenting with 'phygital' stores and the metaverse; and Magrabi Retail Group, the Middle East's leading fashion eyewear and medical eye care specialist with 150 stores in five countries.