Investing for a better world

Modernizing infrastructure is creating new market opportunities.

The innovations and adaptations enabling our built environment to sustainably run at higher capacity, increased quality, and lower cost.

For many of us, industrial and transportation capabilities can fade into the background – we take them for granted. But arguably, they do more to shape the physical world around us than any other sector.

The disruptions caused by the global pandemic and the war in Ukraine have brought these sectors back into the foreground. And the disruptions have accelerated a drive to modernize the infrastructure that connects supply chains together, which may make supply chains more resource and energy efficient.

As modernization efforts come to fruition, our natural, built, and lived environments should become more effective, efficient, and sustainable. And this will create new markets. As Kelsey Perselay, Industrial Sector Specialist, Global Markets at UBS puts it, “The industrials and transportation complex physically builds a better world. These are the companies implementing society’s vision for the future.”

The industrials and transportation complex physically builds a better world. These are the companies implementing society’s vision for the future.”

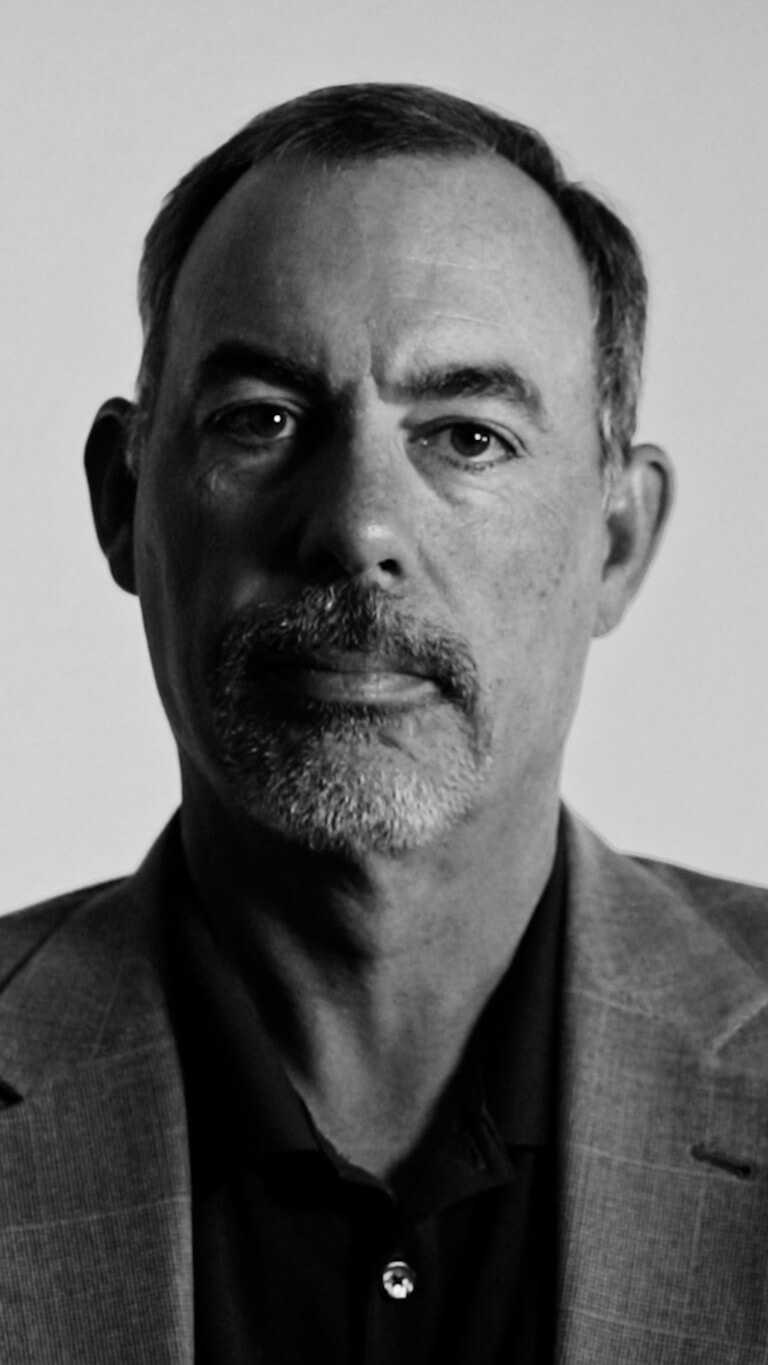

Kelsey Perselay

Industrial Sector Specialist, Global Markets, UBS

Kelsey Perselay. Industrial Sector Specialist, Global Markets, UBS

Streamlining transportation in supply chains

The confluence of recent crises has persistently disrupted global supply chains, causing shortages and price hikes in everything from computer chips to food. It’s a multi-dimensional issue, but Perselay explains that labor shortages are one of the biggest hurdles to normalizing supply chains. “There’s a lot of investment going into warehouse and port automation to fill those gaps,” she says.

Traditional solutions have a role to play too. Jennifer Hamann, Executive Vice President and CFO at Union Pacific – the 160-year-old United States railroad – says, “A truck moving freight from Los Angeles to Chicago requires several drivers. A train can haul 300 times what a single truck can. By transporting goods via rail, instead of truck, our customers are reducing their own carbon footprints.”

Jennifer Hamann. Executive Vice President and CFO, Union Pacific

That efficiency is especially significant as fuel prices escalate, “Rail and intermodal freight are up to 70% more fuel efficient than trucking, however, there isn’t enough capacity on the railroads to fill all the gaps” says UBS Global Research U.S. Freight Transports Analyst Thomas Wadewitz. Hamann says Union Pacific is investing billions to expand capacity and improve service, and over the long-term investing in alternate propulsion battery electric locomotives.

Internationally, disrupted shipping lanes have caused an increasing reliance on air freight. But UBS Global Research indicates that capacity is squeezed here too, as an increase in consumer travel has reduced the available cargo capacity of passenger flights.

But significant investment in dedicated air freighters should expand capacity. According to UBS Global Research, Boeing anticipates a 60% increase in dedicated cargo fleets by 2039.

The increase in capacity may help ease international supply lane disruption. It may also partially alleviate cost pressure, as a McKinsey study found that with each new generation of aircraft there is a double-digit improvement in fuel efficiency.

Digitalizing housing

Similar pressures are at play in housing. An undersupply of homes in the U.S. and elsewhere was already pushing up prices before the pandemic. More recently, UBS Global Research indicates that supply disruption is inflating raw material costs, and labor shortages are impacting construction project plans. “We believe the housing supply and demand imbalance will even out by 2026,” says UBS Global Research U.S. Homebuilding & Building Products Analyst John Lovallo, “but the construction sector urgently needs cost efficiencies to offset the price of materials, and solutions for building with fewer laborers.”

Two innovations may help to address both issues. First, an increase in prefabricated construction, where homes are built modularly in a factory to be assembled on-site, significantly reduces labor requirements. Second, the industry is digitalizing, adopting virtual design tools like digital twins to optimize the planning process, and ‘connected construction’ software to better coordinate materials and labor.

Digitized efficiency is making its way inside the home, too. Mike Carlet, CFO of smart living company Snap One, says solutions are already available to, for example, “have your house know where you are and what lights you want to go on or off,” as well as adjusting the temperature “when you’re out of the room so you don’t have to set a schedule or adjust it yourself.”

Mike Carlet. CFO, Snap One

Carlet says there’s more to come. “We think we're in the very early innings of the connectivity of the home. If you think about what's happening today at some of the higher end homes, that still needs to ripple down.”

Localizing industry – and improving sustainability

Parallel imperatives to bolster supply chains and reduce carbon emissions are driving many manufacturers to “re-shore their operations,” says UBS Global Research Industrials Analyst Chris Snyder. “Having outsourced production for lower labor costs, U.S. companies are bringing it back home.”

The upshot is higher labor costs, but Snyder says, “over the total cost of ownership, production costs should be roughly the same.” And digitization, along with other efficiencies, are helping to drive costs lower – as well as reducing dependence on overseas energy sources, creating a “$500bn per annum opportunity for the U.S.”

Part of the onshoring opportunity lies in cultivating a local circular economy: working with local partners to close the loop between production and disposal, with the fewest carbon miles in between.

A striking example comes from Clean Harbors, “the greenest company you’ve never heard of,” according to Mike Battles, Executive Vice President, and CFO. Clean Harbors works to dispose of industrial and hazardous waste as safely and cleanly as possible. But that mission is extending into circular resource use says Battles, “We try to recycle whatever we can, whether it be solvents, motor oil, or metals.”

Battles is particularly proud of Clean Harbors’ recycled motor oil, “We take dirty motor oil that comes out of your passenger car, refine it, and sell it back as diesel or motor oil. And that can be done an infinite number of times. Recycled oil boasts 78% lower carbon emissions than virgin crude oil over its lifecycle,” he says.

We take dirty motor oil that comes out of your passenger car, refine it, and sell it back as diesel or motor oil. And that can be done an infinite number of times. Recycled oil boasts 78% lower carbon emissions than virgin crude oil over its lifecycle.”

Mike Battles

Executive Vice President and CFO, Clean Harbors

Mike Battles. Executive Vice President and CFO, Clean Harbors

Waste management company Casella Waste, Inc. is also pushing for this kind of circular resource use. It works with industrial clients to “find ways to redevelop their production processes and get back into the recycling stream,” says Ned Coletta, President and CFO of Casella Waste Systems, Inc. “Innovation is our business. It's helping to drive additional recovery of materials.”

Ned Coletta. President and CFO of Casella Waste Systems, Inc.

Renewing the world around us

The drive to modernize to increase efficiency and profitably scale capacity existed before the recent crises that have impacted society and business. But crises tend to accelerate change, and this time we see that again. The adaptations and innovations underway to make our infrastructure more efficient in terms of carbon, resources, and cost are steps in the right direction to renew our environment for a cleaner, leaner, more sustainable age.

“Industrials are everywhere around us,” says Perselay. “I think it’s amazing to watch these old economy type companies spearhead the modernization of the real world. The market opportunities created in the sector as funding, innovation, and strategy combine will change our world for the better.”

Investing for a better worldConnecting people, ideas and opportunities